Social Market Analytics, Inc. (SMA) is celebrating six years of out-of-sample data in US Equities. This data is unique in that it is a true representation of the Twitter conversation at each historical point-in-time.

Since our launch, SMA has become a leader in providing sentiment data feeds to the financial community. Our data has become an integral part of our customers investment process. Our customers are Quantitative Trading Firms, Hedge Funds, Sell Side Brokers, Traders and many others. SMA data is suitable for HFT, Quantitative Trading, Risk, Short Lending, Smart Beta, Fama-French Models, VAR among others. Predictive signals range from a few minutes to quarterly.

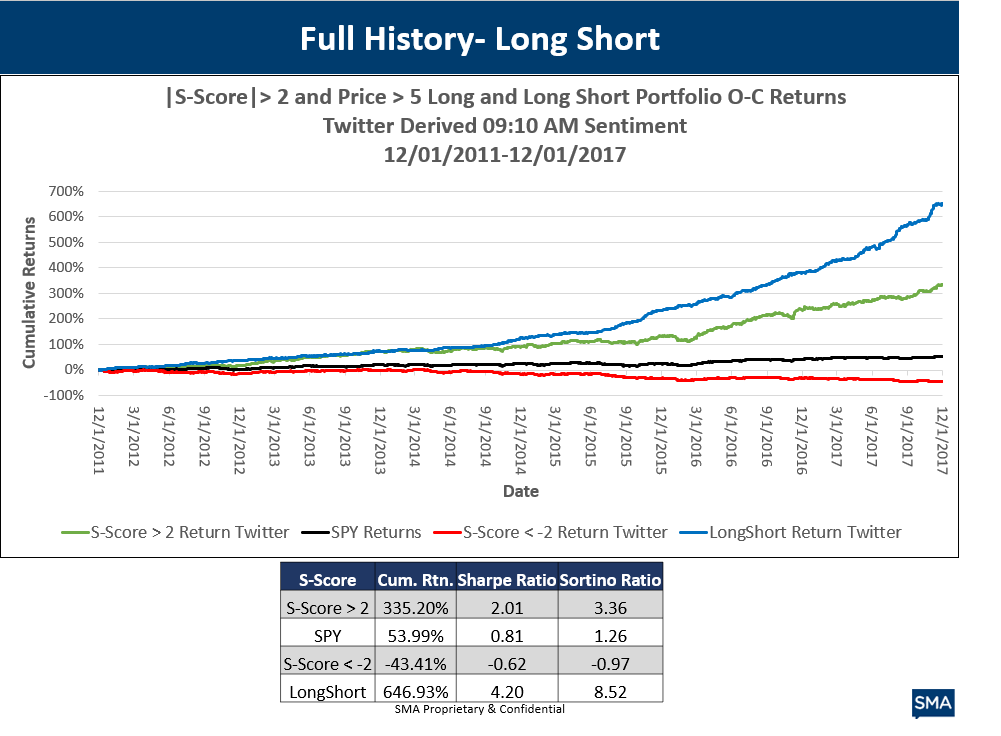

SMA's analytics generate high-signal data streams based on the intentions of market professionals. Our patented machine learning process has produced six years of strongly predictive data as illustrated in the chart below. This chart illustrates the subsequent performance of stocks based on pre-market open (9:10 am Eastern) sentiment scores. Stocks with high sentiment subsequently out perform as illustrated by the Green line. Stocks with strong negative sentiment go on to under perform as evidenced by the red line. The blue line represents a theoretical equally weighted long short portfolio. The table below illustrates Sharpe and Sortino ratios.