Social Market Analytics (SMA) provides real-time sentiment data for equities (North America & LSE), commodities, foreign exchange, Crypto Currencies and ETF's.

In this blog I am going to explore a trading system using the SMA Twitter based sentiment data to trade a basket of: EURUSD, EURGBP, GBPJPY, GBPUSD ,USDCAD ,USDCHF ,USDJPY.

We will explore two straight forward trading systems:

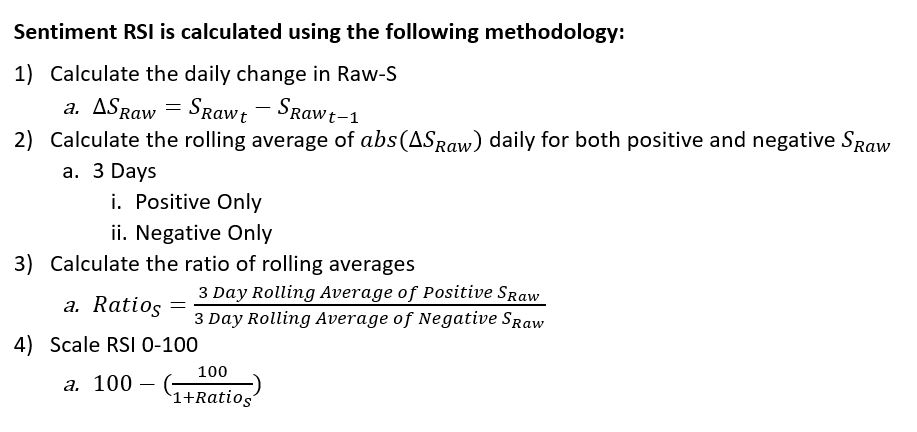

RSI Calculation Methodology

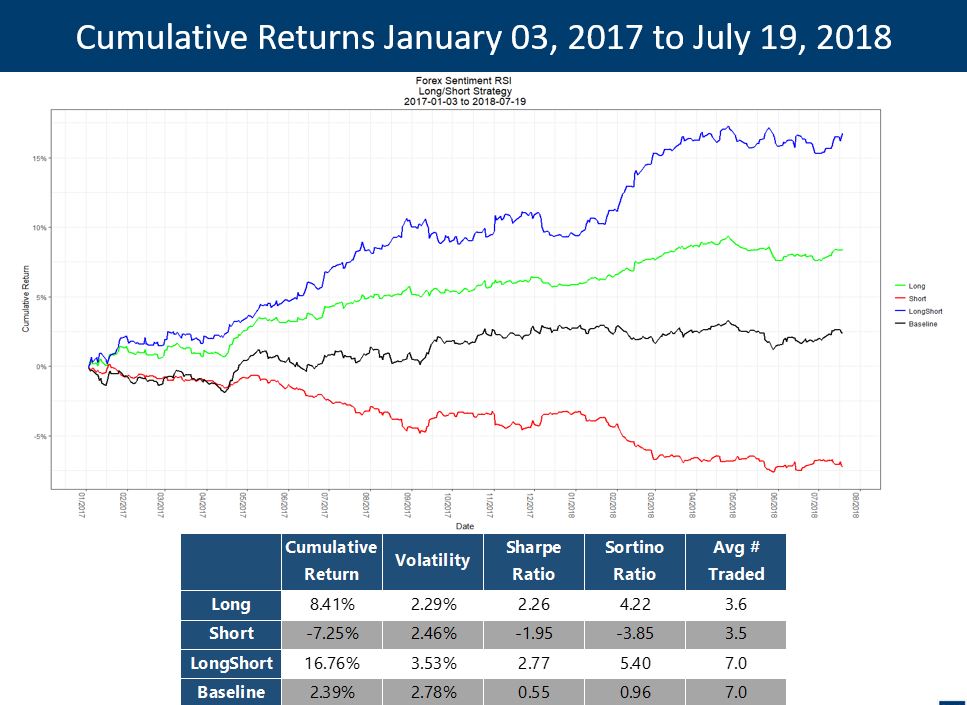

This strategy is a single-factor model solely based on adjusting daily weights according to 3-Day Sentiment RSI on the 7 of the highest daily volume Forex pairs. It is long-short with the assumption that tails act with similar magnitude.

The strategy significantly improves returns compared to an equal weighted baseline. Sharpe and Sortino ratios are statistically significant:

The volatility of each leg of the strategy is either kept stable or decreased in comparison with the baseline.

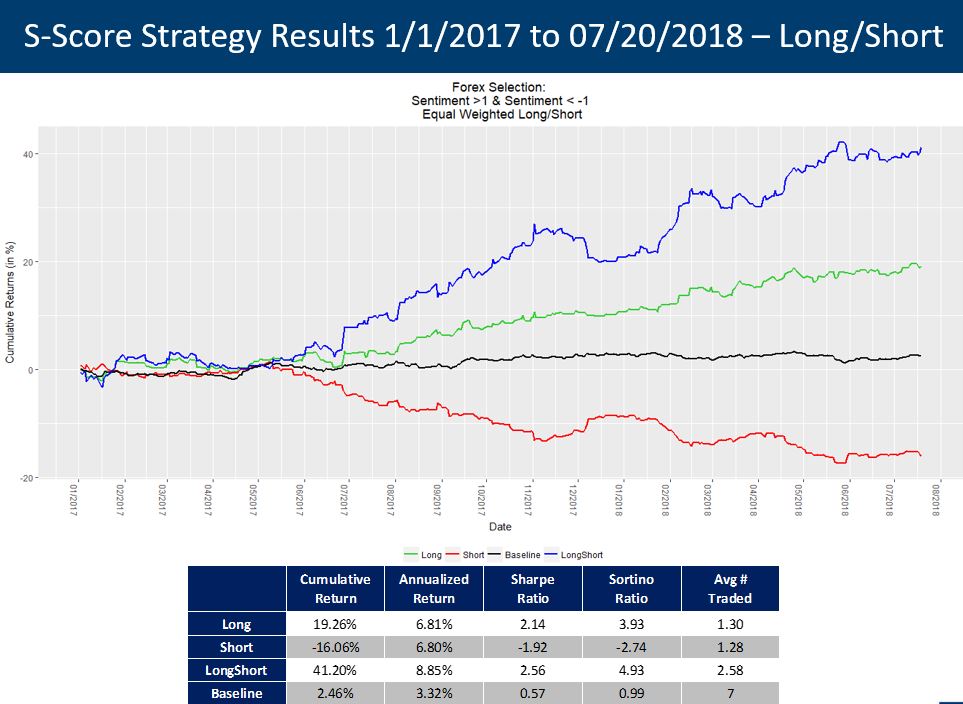

SMA S-Score Based Currency Selection Model

This daily trading strategy is based on the S-Score at 09:10:00 EST and executing a 24-hour hold based on these values at 09:15:00 EST. We find consistency across execution times. The goal is to assess sentiment and take make a directional trade in agreeance, given that the sentiment falls at least 1 standard deviation from the 20-day mean.

Equal weighted based on standard deviation criteria:

- Long: S-Score > 1

- Short: S-Score < -1

- Baseline: Equal Weighted Portfolio of the 7 Currency pair

Long and short legs are capped at 50% of the daily portfolio, even on the occurrence of an outlier day where all pairs are long, or all pairs are short.

The strategy drastically improves returns compared an equal weighted baseline. Up to 40% cumulative over a 19-month period with a consistent annual rate of return.

These are straight forward strategies that illustrate the predictive nature of our dataset. Twitter and StockTwits based factors. To learn more about how Social Market Analytics sentiment data can help your trading please contact us at contactus@Socialmarketanalytics.com or Doug Hopkins @ (312) 788-2621.