Since the now famous GameStop (GME) short squeeze we have received inquiries about Twitter’s ability to identify short squeezes early and do we have any products to help identify these stocks prior to the squeeze? In fact, Twitter is excellent at identifying early discussions of short squeezes. We have a pre-market open Short Squeeze Alert Report to notify customers of securities with abnormally significant short squeeze discussions.

At Social Market Analytics we have identified a corpus of words and phrases that identify possible short squeezes. As we read Tweets in real-time, we identify the topic of conversation. For the last year we have been publishing a list of securities with significant number of short squeeze markers prior to market open. Clients have found this report to be very helpful for risk and security selection. We can run this report multiple times a day.

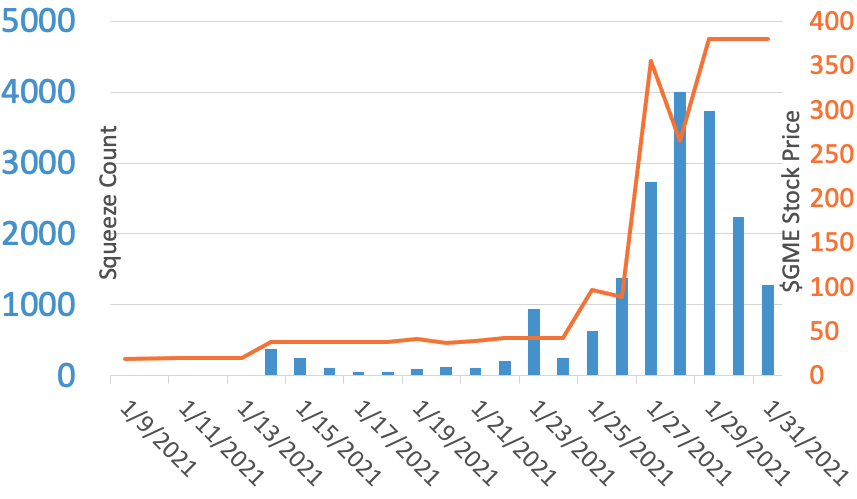

To illustrate the power of this report let us look at GameStop. GME had been an active member of the SMA short-squeeze list prior to the main squeeze in late January. GameStop was number one on the short squeeze indicator from January 12th through the 31st. The Blue bars below represent the number of squeeze indicator phrases for GameStop by day. Short squeeze indicators are taken 20 minutes before the open. The orange line represents the subsequent open price. As you can see from the graph, we started indicating strongly on the 14th with very strong indicator on the weekend of the 23rd. This report also indicated the recent Silver short squeeze.

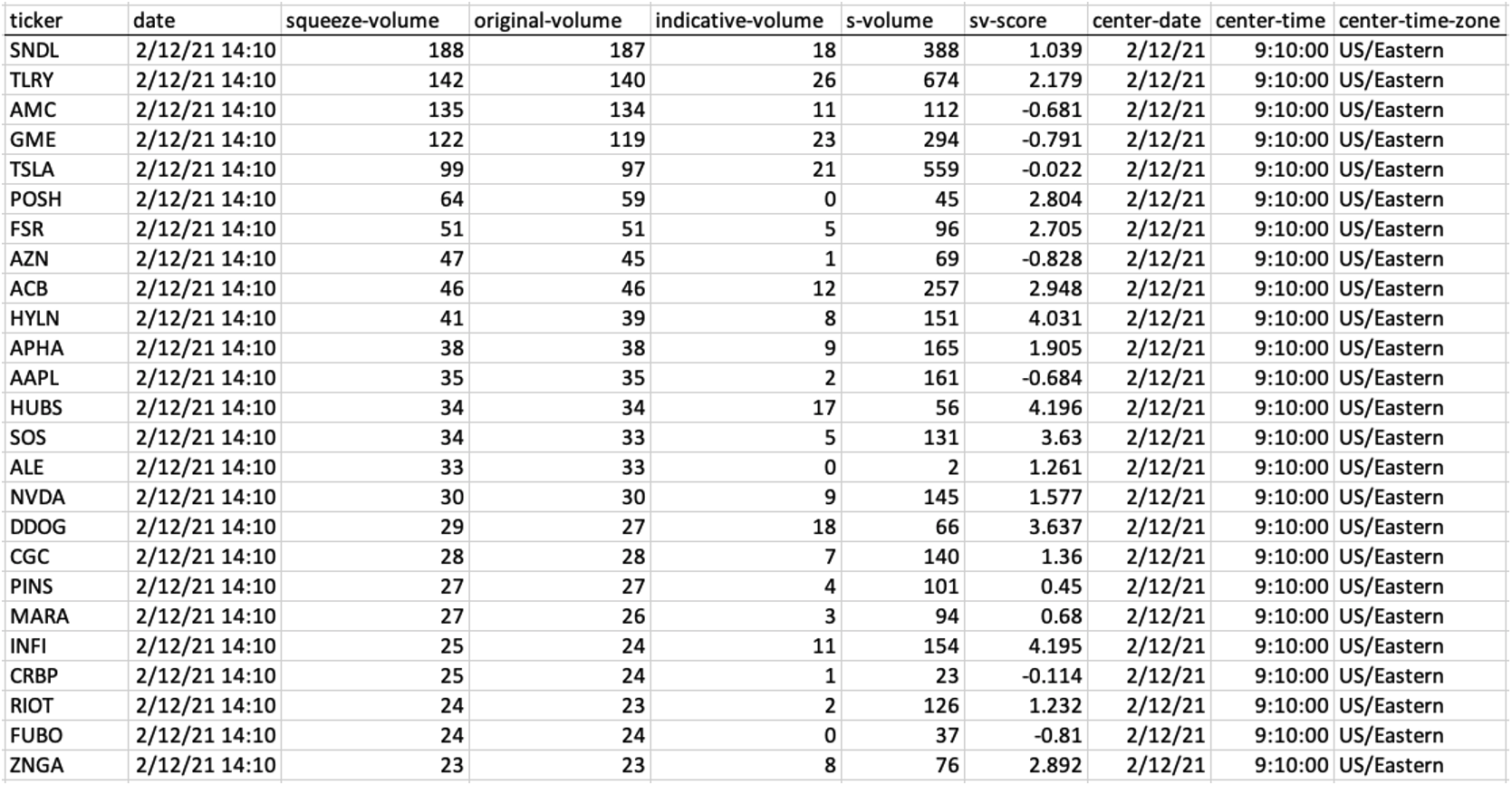

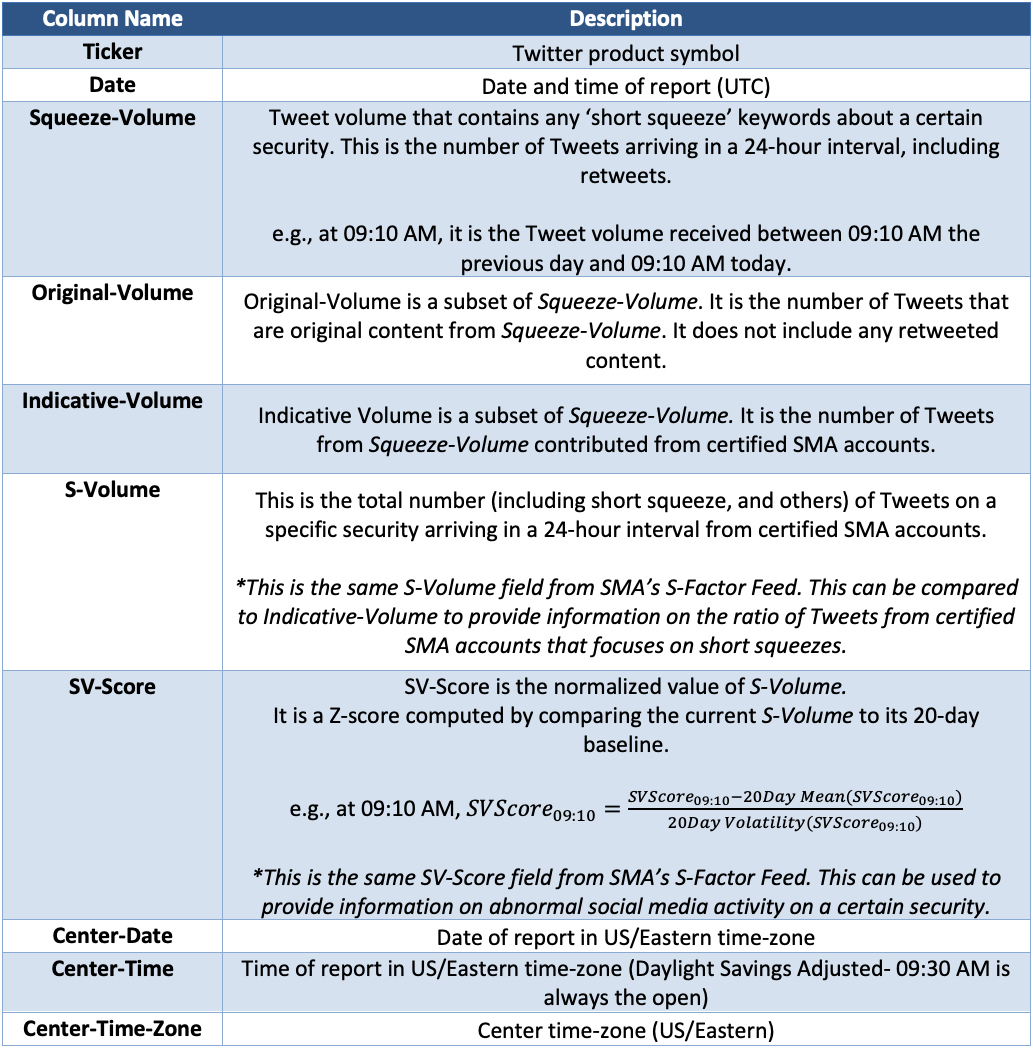

To identify potential short squeezes for customers we built the below report. Again, this report is sent prior to market open to identify high potential short squeeze stocks for the coming day. SMA's Short Squeeze data feed is available through a RESTful JSON and XML API or as FTP files. The data can be packaged at different timestamps throughout the day. (e.g., pre-open at 9:10am ET, pre-close at 15:40pm ET, etc.)

To learn more about this or any SMA product, please ContactUs@contextanalytics-ai.com.